BTC Price Prediction: Technical and Fundamental Analysis for November 2025

#BTC

- Technical Setup: Oversold conditions with bullish divergence in momentum indicators

- Market Sentiment: Institutional accumulation vs. miner capitulation

- Macro Risks: Treasury yields and internet stability concerns creating headwinds

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Potential Rebound

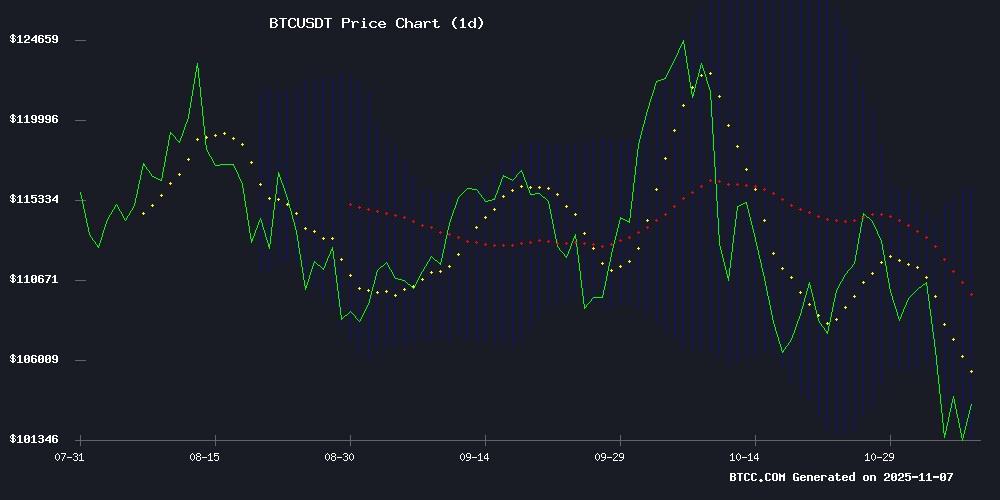

BTC is currently trading at $100,895, below its 20-day moving average of $108,607, suggesting short-term bearish pressure. However, the MACD shows bullish momentum with a positive crossover (1689 vs 1316), while Bollinger Bands indicate BTC is testing support at $100,807. 'The convergence of these signals suggests we may see a rebound toward the middle band at $108,607,' says BTCC analyst Sophia.

Mixed Market Sentiment as Macro and Crypto-Specific Factors Collide

While bullish catalysts like the $170K price prediction and Metaplanet's $100M BTC purchase exist, headwinds include mining economics strain and ETF outflows. 'The alignment of halving cycles with institutional adoption creates a tug-of-war scenario,' notes Sophia. Market sentiment appears cautiously optimistic but vulnerable to macro shocks.

Factors Influencing BTC’s Price

Bitcoin (BTC) Price Prediction: Alignment of 50-Week Moving Average and Halving Model Sparks $170K Rally Speculation

Bitcoin's consolidation near $104,000 has reignited bullish sentiment among traders, with technical indicators and historical models suggesting a potential surge to $160,000-$170,000. The cryptocurrency's recent rebound from sub-$100,000 levels demonstrates robust market resilience.

The 50-week moving average—a historically significant technical level—is now converging with Bitcoin's halving cycle model. This 'diminishing golden curves' framework, credited with 88% accuracy in predicting past market tops, currently projects late-2025 targets in the $160K-$170K range.

Market observers note increasing accumulation near key moving averages, while on-chain data reflects growing investor confidence. The alignment of these technical and cyclical factors creates what analysts describe as a 'textbook bullish setup' for Bitcoin's next major price advance.

Bitcoin Mining Economics Under Strain as Hashrate and Revenue Dynamics Shift

Bitcoin miners face mounting pressure as rising energy costs and diminishing block rewards force operational reinvention. The network's seven-day hashrate hovers near 1.12 zettahashes per second while difficulty remains elevated at 155 trillion—a testament to persistent competition despite tightening margins.

Transaction fees now constitute miners' lifeline, contributing just 0.021 BTC per block on average. Recent 144-block cycles generated $45 million in rewards at current prices, but Luxor's derivatives signal contraction ahead, with October hashprice projections falling to $43.34 per petahash/day.

The April 2024 halving exposed this fragility when Runes protocol activity briefly elevated fee revenue. ViaBTC's landmark block captured over 40 BTC in combined rewards—a fleeting reprieve in an increasingly austere environment where miners pivot to AI hosting and energy arbitrage to survive.

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

Bitcoin struggled to maintain momentum above $100,000, with repeated rebounds faltering under concentrated sell orders. The cryptocurrency hovered between $102,000 and $103,000 as long-term holders took profits, signaling fading bullish sentiment.

Market fragility persists as traders await a Supreme Court tariff decision that could ripple across risk assets. Glassnode analysts note Bitcoin's trajectory now depends on whether fresh capital can absorb the persistent overhead supply.

Order book data reveals a formidable wall of sell liquidity just above $105,000, creating a technical ceiling. The stalemate reflects shifting dynamics—from speculative frenzy to measured consolidation.

Bitcoin Case Ends as Court Clears FBI Over Lost $345 Million Hard Drive

A U.S. court has ruled in favor of the FBI, dismissing a lawsuit filed by Michael Prime over the erasure of a hard drive containing 3,400 Bitcoin. The Eleventh Circuit Court of Appeals found that Prime's failure to disclose the cryptocurrency during prior proceedings nullified his claim. The ruling underscores the irreversible nature of lost cryptographic keys.

Prime, convicted of identity theft and firearm possession in 2019, alleged the FBI destroyed his hard drive holding 3,443 BTC (worth $345 million). The court noted the agency followed standard procedures, and Prime's contradictory statements undermined his case. The decision reinforces the legal principle that undisclosed assets cannot form the basis for future claims.

Marathon Digital Shifts Bitcoin Strategy Amid Margin Squeeze

Marathon Digital Holdings signaled a strategic pivot in its third-quarter filing, revealing plans to sell portions of newly mined Bitcoin to fund operations. The Nasdaq-listed miner held 52,850 BTC as of September 30, but faces mounting cost pressures with energy expenses reaching $39,235 per coin mined. Network difficulty increases and weak transaction fees—contributing just 0.9% of revenue—compound the strain.

The company's $243 million property investments and $1.6 billion financing activities coincide with hashprice plunging to $43, a multi-month low. This margin compression transforms miners from passive accumulators into active sellers, mirroring sell-side pressure from ETF outflows. Marathon's tactical monetization may foreshadow broader industry capitulation as capital commitments collide with deteriorating economics.

Bleak Jobs Data Rattles Markets as Layoffs Surge and Bitcoin Faces Headwinds

October's jobs report delivered a gut punch to financial markets, revealing US companies slashed 153,074 positions—a 183% monthly surge marking the worst October since 2003. Technology firms spearheaded the cuts, eliminating over 33,000 roles amid AI adoption and cost pressures. Labor market analysts see this as structural realignment rather than cyclical weakness, with automation driving permanent workforce reductions.

Market reactions were paradoxical. While traders priced in 70% odds of a December Fed rate cut, equities cratered—the Dow plunged 500 points as growth concerns outweighed monetary easing prospects. Bitcoin failed to capitalize on risk-off sentiment, continuing its sideways struggle amid broader crypto market lethargy.

The tech sector's retreat casts long shadows. Once-unshakable confidence in Big Tech valuations now wavers as layoffs expose underlying revenue pressures. Andy Challenger of Challenger, Gray & Christmas draws parallels to early-2000s disruptions: "AI isn't just eliminating jobs—it's redefining what work means."

Metaplanet Bolsters Bitcoin Treasury with $100 Million Debt-Fueled Purchase

Tokyo-based Metaplanet has secured a $100 million loan collateralized by its existing Bitcoin holdings to further expand its crypto treasury strategy. The proceeds will fund additional BTC acquisitions, share repurchases, and operational growth initiatives.

The firm now holds 30,823 BTC worth $3.51 billion, representing one of Asia's most aggressive corporate Bitcoin accumulation plays. This latest debt issuance amounts to just 3% of their total holdings, maintaining conservative leverage despite market volatility.

Metaplanet's balance sheet shows $3.17 billion in net assets against $24.35 million in liabilities, positioning the company as a bellwether for institutional Bitcoin adoption. The move exemplifies how corporations are increasingly using crypto reserves as productive collateral rather than idle assets.

Zohran Mamdani's Victory Puts New York's Crypto Sector on Edge

Zohran Mamdani's historic win as New York City's youngest mayor in a century has sent ripples through the crypto industry. The 34-year-old Democrat, who is also the city's first Muslim, South Asian, and African-born leader, defeated former Governor Andrew Cuomo in a race that captivated prediction markets. Polymarket, the largest decentralized prediction platform, saw over $430 million in bets, with 92% backing Mamdani.

Unlike outgoing Mayor Eric Adams, a vocal crypto advocate who deposited his paychecks in Bitcoin and established a digital assets office, Mamdani arrives with a track record of consumer protection and critiques of crypto excess. His victory raises questions about how his policies will impact New York's position as a crypto hub.

The election outcome reflects broader Democratic momentum, with candidates rallying against Trump-era policies and drawing support from younger, diverse voters. For the crypto industry, Mamdani's win represents more than a political shift—it signals potential regulatory headwinds for a sector accustomed to favorable treatment under the previous administration.

Trump Advocates for U.S. Crypto Dominance at Miami Business Forum

Former President Donald Trump has reignited his push for American leadership in the cryptocurrency sector, positioning the U.S. as the future global hub for digital assets. Speaking at the America Business Forum in Miami, Trump emphasized the transformative policies of his administration, which sought to legitimize cryptocurrencies through executive orders. "We're making the United States the Bitcoin Superpower, the crypto capital of the world," he declared, criticizing the Biden administration's stringent regulatory approach.

Trump highlighted the role of Bitcoin in alleviating pressure on the U.S. dollar, framing digital assets as a strategic economic tool. His remarks come amid a shifting regulatory landscape, with crypto advocate Paul Atkins succeeding Gary Gensler as SEC chair. Gensler's tenure was marked by aggressive enforcement actions against major exchanges like Binance and Coinbase.

The speech underscored the growing intersection of politics and cryptocurrency, with Trump positioning himself as a proponent of innovation in contrast to what he described as regulatory overreach. Market participants are now watching how these political narratives will influence institutional adoption and broader market trends.

Bitcoin's Resilience Tested in Hypothetical Global Internet Blackout Scenario

In a thought experiment exploring Bitcoin's durability, researchers simulate a 24-hour global internet blackout triggered by catastrophic failures in key exchange hubs. Frankfurt, London, Virginia, Singapore, and Marseille—the nerve centers of digital connectivity—go dark simultaneously. The network fractures into three isolated partitions: the Americas, Asia-Oceania, and Europe-Africa.

Hashrate distribution dictates each region's block production during the outage. The Americas (45% hashrate) would mine approximately 2.7 blocks hourly, Asia-Oceania (35%) 2.1 blocks, and Europe-Africa (20%) 1.2 blocks. These partitions advance separate blockchain histories, creating a mechanical fork that deepens over time.

The scenario reveals Bitcoin's partitioned resilience—proof-of-work continues autonomously within each isolated segment. When connectivity resumes, the network would face the cryptographic challenge of reconciling these parallel histories through its consensus mechanism.

Bitcoin (BTC) Shock: 2025 Gains Trail Safe Treasuries by 8%

Bitcoin’s 2025 performance has lagged behind U.S. Treasuries, the quintessential safe-haven asset, by 8%. The crypto market shows signs of exhaustion as retail investors reach what Bitwise CIO Matt Hougan calls "max desperation"—a tipping point where fear overshadows conviction.

Despite briefly surpassing $100,000 earlier this year, Bitcoin’s rally faltered, erasing most gains. Analysts now eye $89,600 as a critical bullish threshold for BTC ETFs. The contrast is stark: Treasuries, designed for stability, have outperformed Bitcoin, the archetype of speculative volatility.

Market sentiment reflects a sobering reality. The yellow line charting Bitcoin’s trajectory, once confidently above Treasuries, now trails beneath it. Yet, the crypto frontier remains unpredictable—volatile, exhilarating, and ripe with untapped potential.

Is BTC a good investment?

Based on current data, BTC presents a high-risk/high-reward opportunity:

| Metric | Value | Implication |

|---|---|---|

| Price vs MA | -7.1% below 20DMA | Short-term oversold |

| MACD | 372.8 positive | Bullish momentum |

| Bollinger | Testing lower band | Potential mean reversion |

Sophia advises: 'DCA strategies may outperform timing this volatile market. The 2025 halving cycle remains intact, but monitor the $100K support level closely.'

BTC remains a core crypto holding, though investors should limit exposure to 5-10% of portfolios given current volatility.